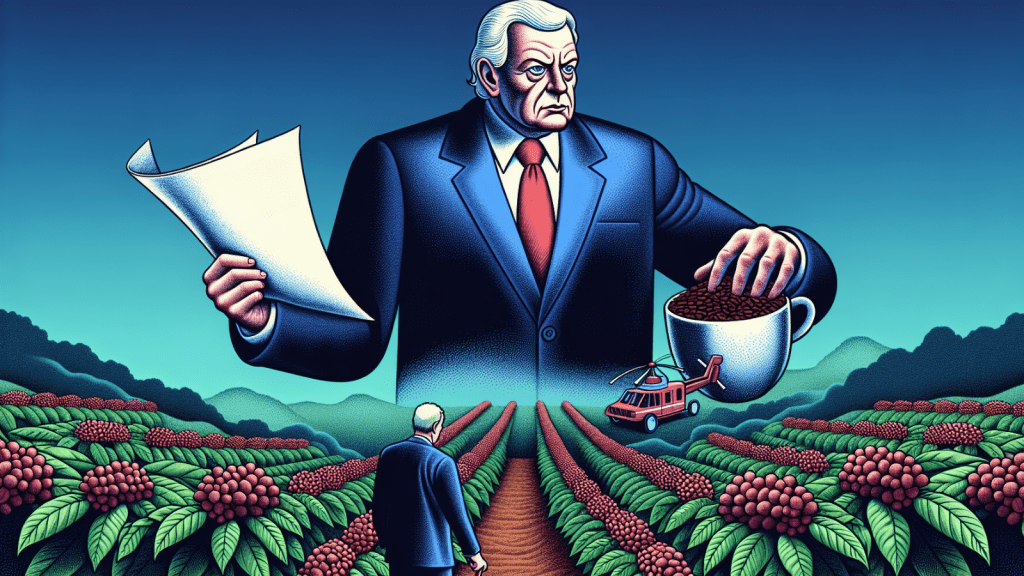

As discussions about a potential second term for former U.S. President and president-elect Donald Trump intensify, industries worldwide are evaluating how his policies and regulations could impact their operations. Among these industries is the coffee sector—a global market that may face significant disruptions due to changes in trade policies, tariffs, and environmental directives under a new Trump administration.

Given its reliance on international supply chains and sensitivity to market fluctuations, the coffee industry is particularly vulnerable to geopolitical and economic shifts. A second Trump presidency could bring both challenges and opportunities for stakeholders across the coffee value chain, from producers to retailers.

Trade policies: Tariffs and the coffee market

One of the key concerns about a Trump return to office is his approach to trade policy, particularly tariffs. During his first term (2017–2021), Trump pursued an “America First” trade agenda that involved renegotiating trade agreements and increasing tariffs on imports to protect domestic industries. This included reforms like the United States–Mexico–Canada Agreement (USMCA) and tariffs on goods from countries like China.

Currently, coffee imports to the United States are exempt from tariffs, which helps keep prices relatively stable for consumers. However, if tariffs were introduced under a revised trade policy, it could significantly disrupt the coffee market.

For the coffee sector – where over 70% of consumption depends on imports from Latin American countries like Brazil, Colombia, and Honduras – new or increased tariffs on agricultural imports could disrupt supply chains. Brazil and Colombia, two of the largest coffee producers globally, are critical suppliers for the U.S. Escalating protectionist measures could increase costs for exporters, causing price volatility in the U.S. market.

Agricultural products have been targeted in past trade disputes. For example, during Trump’s first term, retaliatory tariffs impacted U.S. exports like soybeans.. Commenting on Trump’s current proposals, Time notes that his trade agenda could involve “a universal tariff of 10% to 20% on all imports and as high as 60% on goods from China”. Such measures could spell trouble for coffee importers reliant on competitive pricing.

Smaller specialty coffee importers, in particular, may struggle under a strained trade environment. Increased costs could hurt their profitability, ultimately leading to fewer choices and higher prices for consumers in the U.S.

Trump’s agenda could involve “a universal tariff of 10% to 20% on all imports and as high as 60% on goods from China”.

Environmental deregulation: Challenges to sustainability

Another concern for the coffee industry under a second Trump presidency is environmental deregulation. In June 2017, Trump withdrew the U.S. from the Paris Climate Agreement, citing economic costs. His administration also rolled back numerous environmental protections, including regulations on greenhouse gas emissions and sustainable agricultural practices.

Coffee production is highly dependent on stable environmental conditions, as crops are sensitive to climate variations. Rising temperatures and erratic weather patterns linked to climate change have already reduced yields in coffee-growing regions, threatening the livelihoods of smallholder farmers. Looser environmental regulations could accelerate degradation in coffee-growing environments, compounding these risks.

Reflecting on a potential second term, UCLA Law experts observed that Trump’s administration is likely to “fail to conform to basic requirements of U.S. federal environmental law, including the Clean Air Act, the Clean Water Act, and likely now the Inflation Reduction Act”. For the coffee sector, this could mean weakened environmental protections that disrupt sustainability initiatives.

Many major coffee brands and importers have integrated sustainability efforts into their operations, from organic certifications to carbon-neutral supply chain commitments. However, a second Trump presidency could hinder these efforts, creating reputational risks for companies that pride themselves on eco-conscious practices.

Geopolitical uncertainty and market volatility

Geopolitical uncertainty under a second Trump administration could further complicate the coffee sector. Trump’s unpredictable diplomatic strategies often led to market volatility, making it harder to ensure consistent supply, manage risk, and stabilize pricing in coffee futures markets.

Political instability in coffee-producing regions is another critical factor. Many Latin American countries are vulnerable to trade policy shifts and could face economic challenges if relations with the U.S. deteriorate under a renewed Trump presidency. Supply chains for coffee could be further strained, leading to ripple effects across the global market.

Without clear and consistent policies, businesses that depend on globally sourced commodities like coffee may struggle to make long-term strategic decisions. The coffee industry, built on intricate international trade relationships, would need to prepare contingency plans to weather potential disruptions.

A second Trump presidency could have far-reaching implications for the coffee sector. From trade policies and tariffs that disrupt global supply chains to environmental deregulation that threatens fragile coffee-growing regions, the industry faces a mix of risks. Geopolitical uncertainty and market volatility would likely add to the challenges, creating pressure on stakeholders across production, distribution, and retail.

The coffee industry’s ability to adapt will depend on how businesses navigate these shifting political and regulatory landscapes, when Donald Trump returns to the White House.