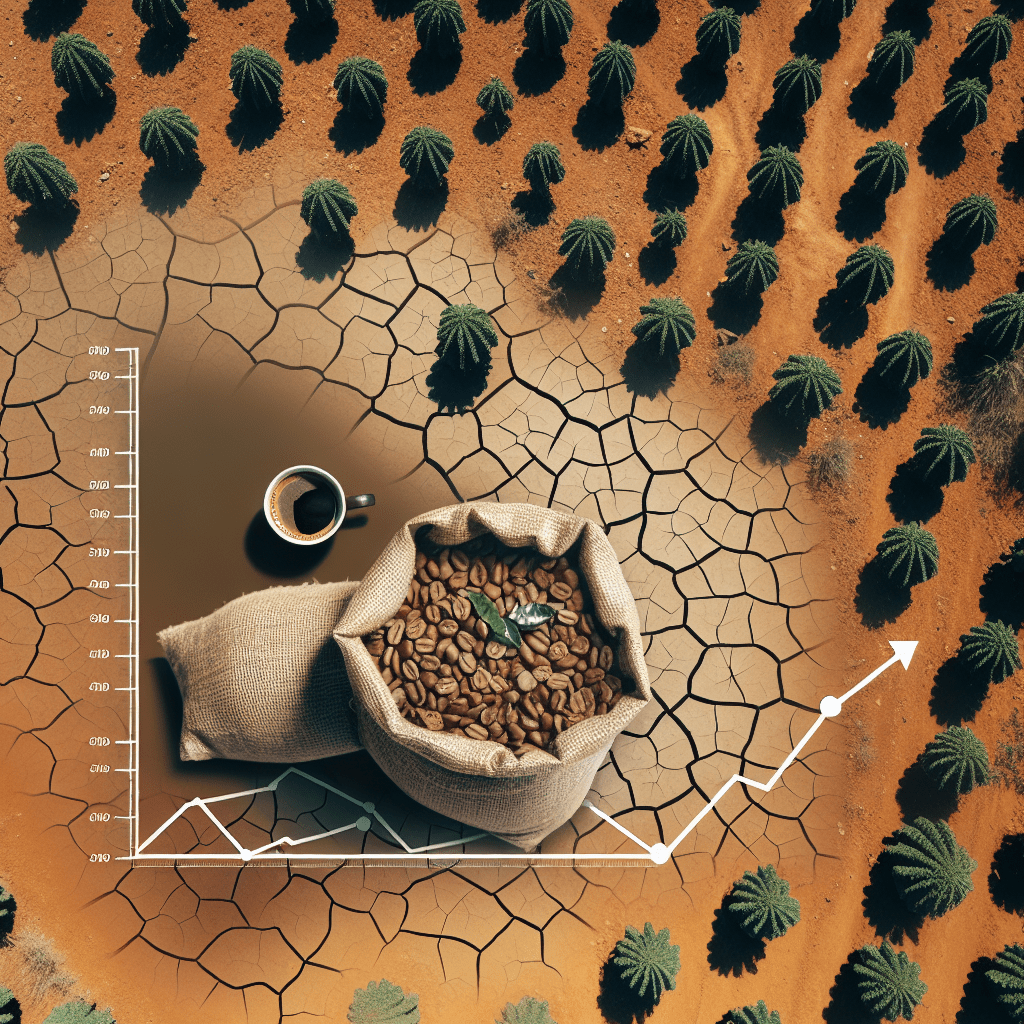

Brazil, the world’s largest coffee producer, is facing a critical environmental challenge as severe drought conditions affect its agricultural outputs. These weather conditions are raising serious concerns over global coffee supply chains and are expected to drive up coffee prices across international markets. The consequences of Brazil’s drought stretch far beyond its borders, creating ripples felt by both consumers and producers worldwide.

How Brazil’s Drought Impacts Coffee Cultivation

The ongoing drought in Brazil has led to a sharp drop in rainfall, with some regions experiencing deficits of up to 50% below the seasonal average, as reported by the National Institute of Meteorology (INMET). This lack of precipitation is particularly detrimental to coffee cultivation, which relies heavily on consistent rainfall patterns. Agronomists have sounded the alarm on the implications for coffee crops.

According to Carlos Alberto de Jesus Silva from Embrapa Coffee Research Center, “Drought stress can lead to smaller bean sizes and lower overall production.” Such reduced yields not only affect the volume of coffee produced but also its quality, which could further exacerbate the volatility in the market (VICE).

A sustained drought impacts not only the size of the beans but also delays in the flowering and fruiting stages of the plant cycle, resulting in potentially inferior crop outcomes. This could have long-lasting effects on Brazil’s ability to maintain its export volumes and high standards known globally for its Arabica beans.

Surge in Coffee Prices Linked to Brazil’s Reduced Output

Global coffee markets are already reacting to Brazil’s strained production capacity. In September 2023, Arabica coffee futures soared above $2 per pound, the highest levels since early 2022. According to data from Trading Economics, Arabica coffee prices have surged by approximately 30% year-to-date, predominantly driven by traders’ concerns over reduced output from Brazil. The coffee trade is particularly sensitive to such shifts, as Brazil supplies a substantial portion of global coffee exports, making any disruption in its production problematic for international markets.

Should this drought continue, market analysts warn that the pricing spikes may only intensify. Forecasts show potential shortfalls in the next harvest, which could result in significant shortages and even higher prices. A Rabobank study warns that if current drought conditions persist through December 2023, Brazil may face a production shortfall of up to 10 million bags compared to previous harvests. This drastic decrease in supply would likely send shockwaves across the entire global coffee market and further strain price stability.

Economic Ramifications for Coffee Producers and Farmers

The drought’s impact reaches down to the local level, where farmers who rely on steady production cycles face deep uncertainty. Coffee farming in Brazil, particularly for smallholder farmers, depends on reliable weather patterns to generate income and plan for future investments. As fluctuating prices take hold of the market, it becomes increasingly difficult for farmers to manage expenses like loans, equipment purchases, and labor costs.

A volatile coffee market also disproportionately affects rural economies within other producing nations that are similarly reliant on stable coffee exports. Given that coffee holds a pivotal place in agricultural trade for many Latin American countries, these drought-induced fluctuations pose considerable risks to economic stability across the region.

Global Trade Adjustments Amid Supply Concerns

International coffee buyers are beginning to adjust their strategies in response to Brazil’s coffee crisis. Some importers, wary of impending shortages, have started stockpiling their supplies of Arabica beans to safeguard against future price hikes. Others are exploring alternative sourcing options from other coffee-producing nations such as Colombia and Vietnam, both of which play vital roles in the global coffee trade.

David O’Connor from the International Coffee Organization (ICO) highlighted the broader ramifications of the current drought, stating, “A prolonged drought will exacerbate existing vulnerabilities within both local economies and international trade networks.” O’Connor underscored the need for continued vigilance around climate change’s long-term effects, not only on Brazil but also on the global agricultural landscape.

Challenges Ahead for Brazil and the Global Coffee Market

As one of the primary sources of coffee in the world, Brazil’s role in the international coffee trade is indispensable. Disruptions in Brazilian production have a cascading effect, influencing key aspects of the coffee value chain—from farmer production levels to consumer-facing pricing. Moreover, climate-related challenges such as extreme drought form part of an increasingly complex web of factors contributing to price volatility, including global market forces, political developments, and logistical challenges related to global shipping.

For stakeholders involved in the coffee market, the outlook remains uncertain as they grapple with unforeseen supply constraints, rising input costs, and fluctuating demand levels. Monitoring Brazil’s drought closely will be key to understanding how deeply it might affect the future of coffee pricing and trade globally.